The Bramwell Brown Blog

How to Spend Inheritance Money

Quick disclaimer: The author is not a financial advisor and this post is not a financial advice. The post is written for educational and entertainment purposes.

Whether or not you were prepared for your inheritance, you may still be unsure about how to spend it. If you have debts, then that is perhaps one of the ways you can make good use of the money. If you don’t, or you still have money left over, it can be tricky to figure out how to make the most of it. A financial advisor can help out if you’re looking to invest, but we also go through a few ideas if you’re wanting to buy something to serve as a reminder of your benefactor and still be a good investment.

Invest in Education

Photo by Alfons Morales

Going back for more education or continuing studies may be an idea that seems too far-fetched for some who wish to keep learning. However, with an inheritance, you may have that chance to try. Maybe it means going back to school for a degree that you’ve always wanted or taking classes that you’ve always had an interest in but never had the time or money to invest in it.

Education is an investment into yourself, so even if you’re not looking to go back to school full time, consider a few courses that may help you out right now. You might be able to do a short program enhancing current skills for your career or sign up for hands-on classes learning a trade that you’ve never tried before. Look at honing skills that are generally useful like home or car repair, or a First Aid class to be prepared when you get stuck in an unfortunate situation.

Heirlooms

Heirlooms are wonderful ways to keep tradition and sentiment alive in a family. There is a rich history of gifting heirlooms to the next generation at pivotal moments in their life and it’s a way to provide for your loved ones and keep your memory alive. If you didn’t receive any heirlooms with the inheritance you can invest a portion of the inheritance on heirlooms that are worth the investment.

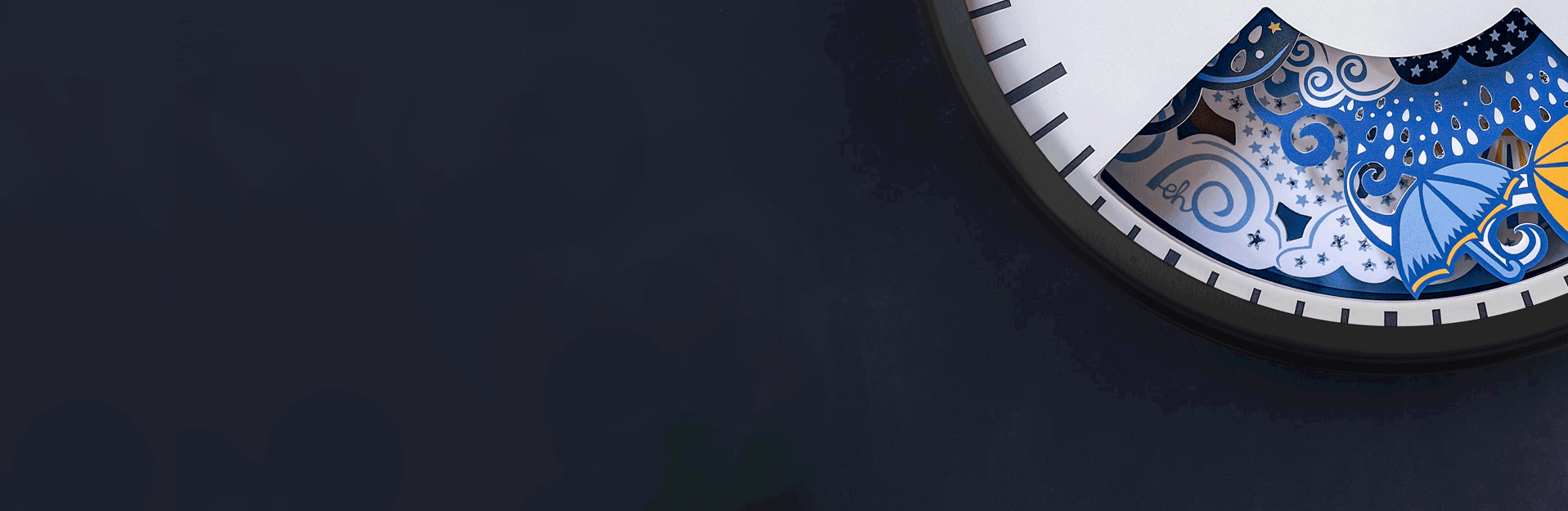

The example we like to talk to about is clocks. A clock can be a timeless statement that gives you a chance to remember your loved one every time you look at it. Depending on the brand and craftsmanship, a clock can also retain or grow its purchase value, which can be an investment that you can get back should you choose to sell the clock. A clock is something that you’ll likely refer to at various points throughout your day and tying the memory of your loved one to it can be a poignant way to remember them.

Certain well-made clocks like Bramwell Brown Weather Clock are special and handcrafted, often meaning that the value of these clocks are quite high years after purchase. These clocks are put together with care and skill, ensuring a lifetime of service with little maintenance or repair. With unique limited edition clocks and clocks that can be personalised, Bramwell Brown can encourage the memory of your loved one and remind you of the gift they’ve bestowed to you.

For more heirloom investment ideas read - 5 Unique Family Heirloom Ideas to Invest In and Pass Down

Home Improvements

Photo by Kara Eads

One great way to spend the money wisely is to put it into something that will increase its value. Spending money on renovations or improvements around your home is something that helps to build equity. You may want to talk to a real estate agent to figure out what improvements are likely to get the best return, but you can also do a few things for your own interest as well.

Maybe you want to recreate a library like the one that was your benefactor’s favourite, or install a pantry designed the way that they would’ve loved. These are small but significant ways to help you feel that you’re carrying on their memory and a reminder of the good things that they’ve encouraged in your life. Renovations to create the home you love is a way to spend your inheritance to bring you some sense of peace and wellbeing as your loved one likely intended.

Recommended Reading: 5 Types of Unique Accessories in Interior Decoration

Take Care of Family

Photo by Tyler Nix

If you’ve got children or nieces and nephews that you love and want to take care of, then consider an inheritance for them. With money that is leftover from your inheritance, you can invest in their needs and expenses like setting up an education fund for them or making sure that they’ve got enough money for a down payment when they’re ready to purchase a home.

You may want to donate some to charity. If your benefactor had a charity they loved and donated to, you can also put some money toward a cause that’s important to you as well. Monthly donations are often more appreciated than one-time donations since they are more reliable. Consider a small monthly donation rather than a big lump sum donation, at the former, will help you to manage your inheritance as well.

Finally, just a few good tips before you do anything with your inheritance:

Make sure to get the money before you start spending it. Usually, estates are settled pretty quickly, in under a year, but in the event that you have to wait for your money you don’t want to incur any debts of spending before you have it in your account to pay. You don’t want to spend yourself into a hole that takes your entire inheritance (or a good chunk of it) to get you back out.

Having a list of important items or tasks for your inheritance is a wise idea since you’ll likely have more than a few options open up to you with your windfall. Prioritise the practical actions that put you in a better position in life and that will have a significant positive impact.

Lastly, in splurging on some of the wishlist items that you’ve had, think about the ongoing costs. You may really want that cottage home or classic car but the maintenance and insurance are also going to have to be covered. Try to get an idea of the entire cost and not just the sticker price.

With these ideas in mind, you can begin to carefully lay out how you would like to spend your inheritance. It’s best to create a plan and stick to it so that the money doesn’t evaporate in expensive impulse purchases.